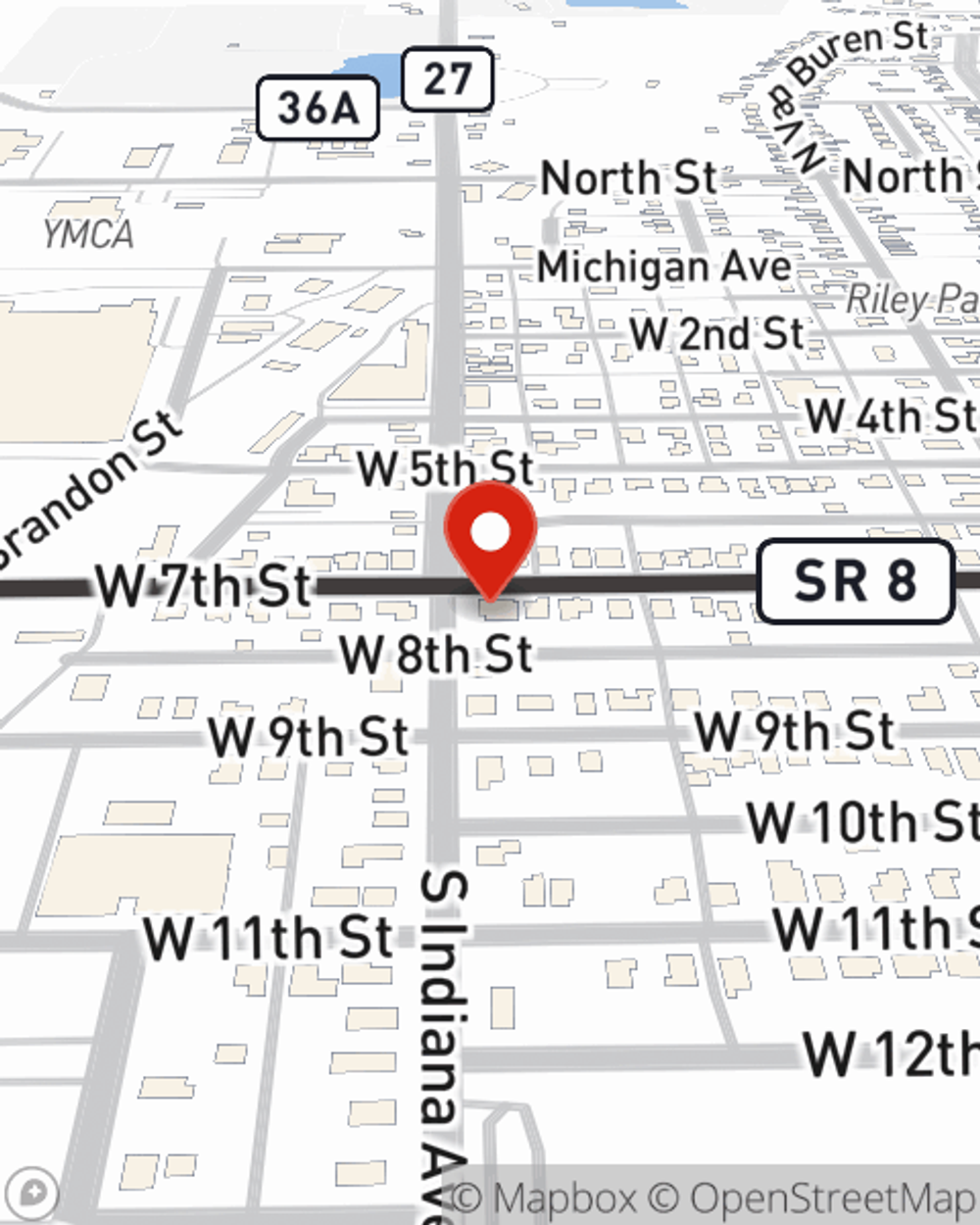

Renters Insurance in and around Auburn

Welcome, home & apartment renters of Auburn!

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Auburn

- Garrett

- Butler

- Waterloo

- Leo

- Spencerville

- Saint Joe

- Laotto

- Huntertown

- Fort Wayne

- Kendallville

- Angola

- Ashley

Home Is Where Your Heart Is

There are plenty of choices for renters insurance in Auburn. Sorting through providers and deductibles to pick the right one is a lot to deal with. But if you want economical renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy impressive value and straightforward service by working with State Farm Agent Morgan Hefty. That’s because Morgan Hefty can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including sound equipment, furniture, electronics, linens, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Morgan Hefty can be there to help whenever mishaps occur, to help you submit your claim. State Farm provides you with insurance protection and is here to help!

Welcome, home & apartment renters of Auburn!

Renters insurance can help protect your belongings

Protect Your Home Sweet Rental Home

Renters insurance may seem like the least of your concerns, and you're wondering if you really need it. But imagine the cost of replacing all the personal property in your rented apartment. State Farm's Renters insurance can help when windstorms or tornadoes damage your belongings.

As a commited provider of renters insurance in Auburn, IN, State Farm strives to keep your valuables protected. Call State Farm agent Morgan Hefty today and see how you can save.

Have More Questions About Renters Insurance?

Call Morgan at (260) 925-2924 or visit our FAQ page.

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Morgan Hefty

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.